Services

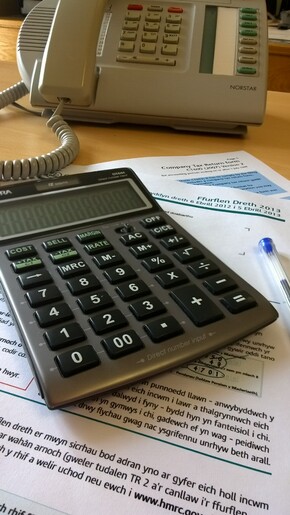

We offer a full-range of accountancy and auditing services to large and small companies and sole traders.

We are professional, bilingual and client focused.

We always aim to smooth out the complications of accounting for our clients. We get to know you and always return phone calls the same day, queries are answered promptly.

Our relationship with clients is of prime importance - there will be at least two team members familiar with every aspect of each client's requirements.

We Provide..

- Accounts Preparation

- Audit of accounts

- Tax Compliance Work

- Self Assessment Tax Returns – Individual and Corporate

- Tax and VAT Planning

- Advice on Accountancy Systems

- Management Information

- Cash Flow Projections

- Full assistance and advice in the process of making tax digital

- Tax credits

Cymraeg